-

Lily Lee

Hi there! Welcome to my shop. Let me know if you have any questions.

Lily Lee

Hi there! Welcome to my shop. Let me know if you have any questions.

Your message has exceeded the limit.

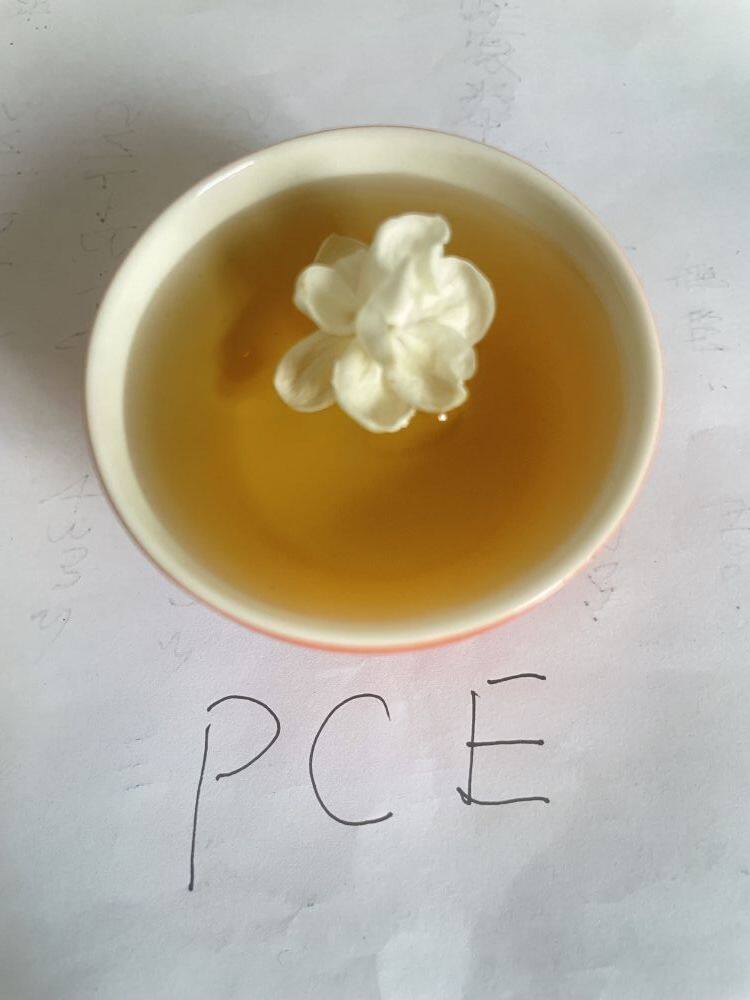

Current Export Status of Polycarboxylate Superplasticizers (PCE) from China

2025-06-30 16:00:38

Current Export Status of Polycarboxylate Superplasticizers (PCE) from China

China's export of polycarboxylate superplasticizers (PCE) is showing a growing trend, with particularly strong performance in Southeast Asia and the Middle East, though challenges remain due to U.S. tariff policies. The key characteristics are as follows:

1. Significant Growth in Export VolumePCE monomer exports in 2024 are expected to reach 300,000 tons, hitting a five-year high with notable year-on-year growth. Some downstream companies have also begun exporting in the form of liquid solutions.

Southeast Asia and the Middle East are the primary export destinations, with HPEG (allyl polyoxyethylene ether) being the dominant product due to its strong adaptability.

Leading companies have reduced reliance on intermediaries by establishing their own foreign trade channels, increasing the proportion of direct exports. Taking Laizhou Guangsheng Chemical as an example, the company has leveraged the logistics advantages of Shandong ports to achieve an average annual export growth rate of 25% to Southeast Asia over the past three years, while gradually expanding into the precast concrete market in the Middle East.

Chinese companies are strengthening their presence in Belt and Road Initiative (BRI) markets (e.g., the Middle East, Africa). Medium-sized enterprises like Laizhou Guangsheng have adopted technology licensing partnerships with local manufacturers to achieve localized compounding of mother liquor, thereby reducing transportation costs.

U.S. tariff hikes have increased export costs for Chinese PCE products. Companies such as Laizhou Guangsheng have turned to transshipment trade through Vietnam to partially circumvent tariffs, while accelerating their shift toward emerging markets (e.g., Eastern Europe, Latin America).

The Middle East and Africa, driven by infrastructure demand, are expected to achieve a compound annual growth rate (CAGR) of 9.5% by 2030. In 2023, Laizhou Guangsheng secured a contract to supply customized retarding-type PCE products for Saudi Arabia's Neom megaproject, marking a breakthrough for mid-sized Chinese companies in high-end markets.

Export volumes are projected to peak at 600,000 tons between 2025 and 2029, accounting for over 30% of total demand, with price fluctuations increasingly influenced by exports.

Green building materials (e.g., low-carbon PCE) and digital delivery (e.g., BIM-optimized formulations) will become new growth drivers for exports.

In summary, China’s PCE exports are transitioning from a cost-driven model to a technology-and-brand dual-driven approach, but continued efforts are needed to address trade barriers and supply chain risks.

Tags: Laizhou Guangsheng Chemical, Polycarboxylate Superplasticizers, PCE